ev tax credit bill text

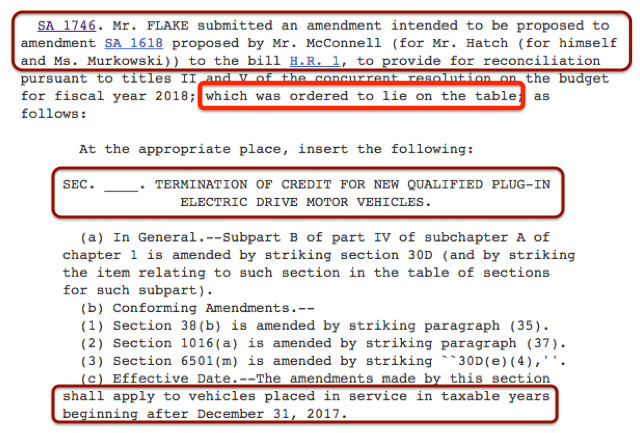

Up until this morning there was still strong hope that Congress would not eliminate the Federal electric vehicle tax credit but a late amendment puts the credit in significant doubt. If this works out it could be a huge boon to the auto industry.

Legislation Regulations Evadoption

Under the proposed scheme buyers of new qualified vehicles would get a 3000 tax credit and buyers of used vehicles get a 2000 credit.

. Federal tax credit for EVs jumps from 7500 to 12500. 13 provides electricity to an electric vehicle by at least two hundred eight 208 14 volts and requires a dedicated circuit. It would limit the EV credit to.

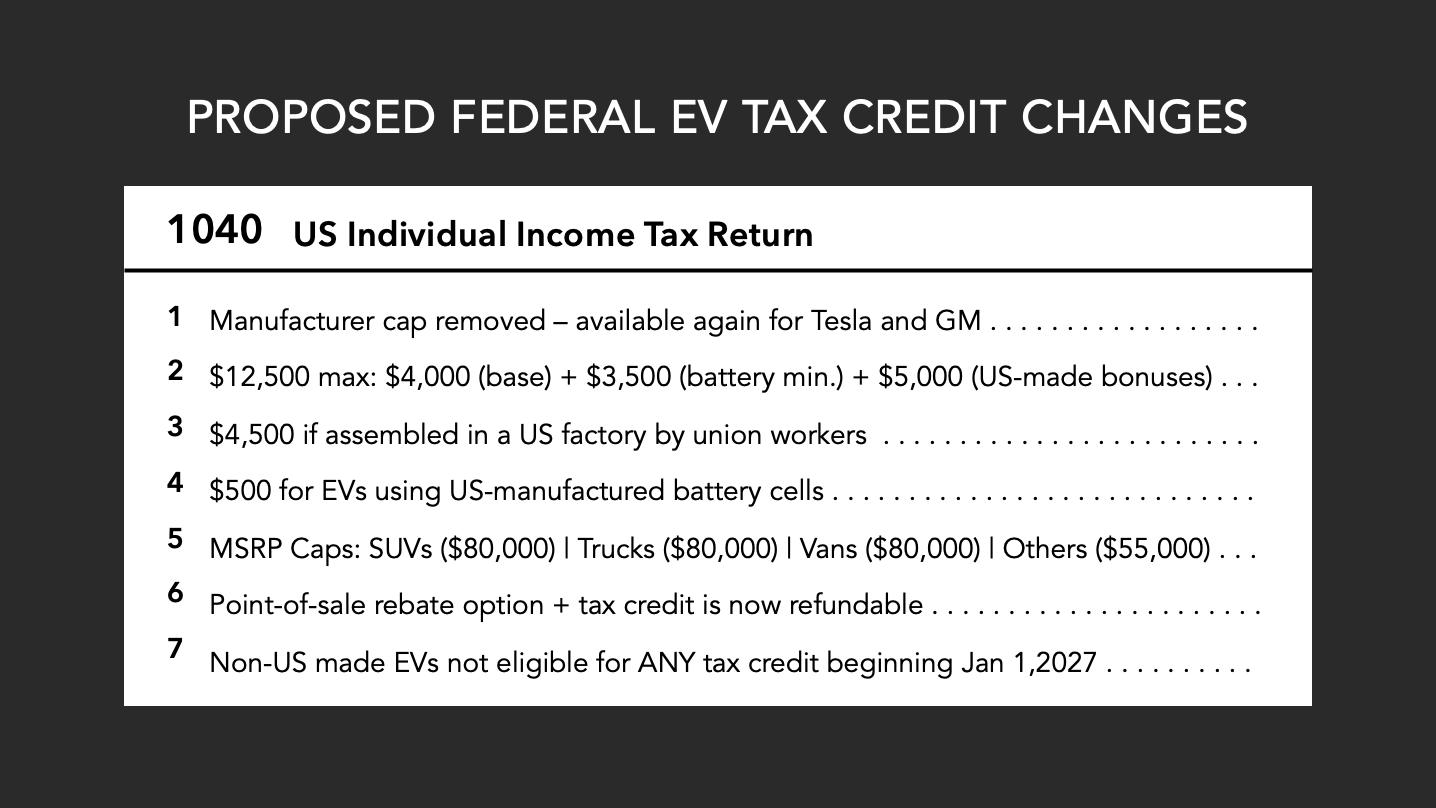

For example the possibility of Tesla and GM once again becoming eligible for the tax credit could be big news for consumers. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year. Bidens Build Back Better Framework Retains 12500 EV Tax Credit The 555 billion spending bill needs to pass both houses of Congress to.

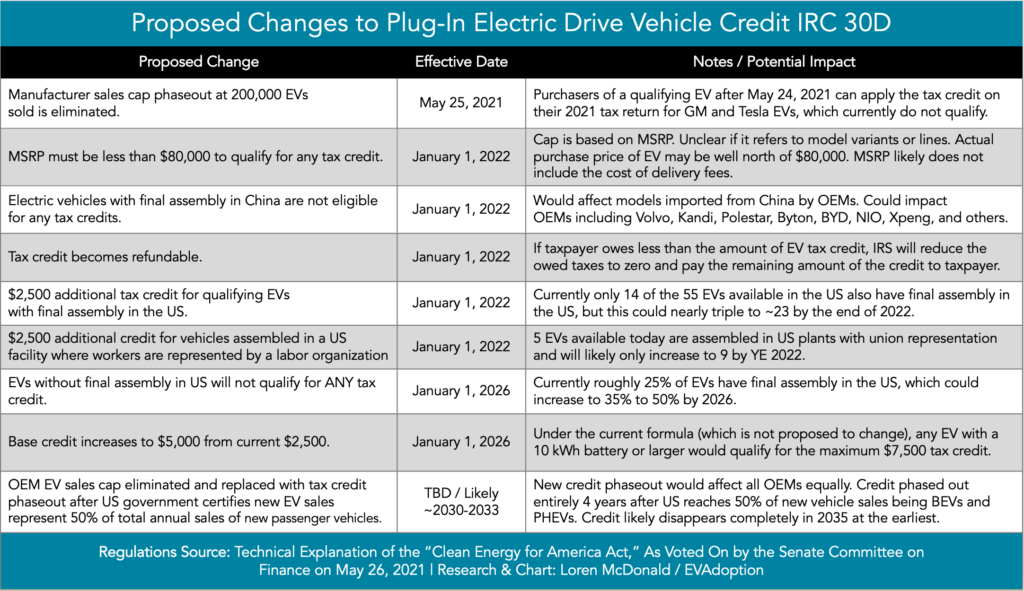

Keep the 7500 incentive for new electric cars for 5 years. If the Build Back Better bill passes both the House and Senate it will make the EV tax credit refundable which would put at least 4000 and up to 12000 back in buyers pockets. NADA supports tax credits to incentivize the purchase of EVs but cannot support the bill in its current form.

Introduced in the Senate Referred to Senate Environment and Energy Committee. 14 the House Ways and Means Committee debated electric vehicle EV tax credits as part of the budget reconciliation bill and those provisions will be voted on today. When I woke up this morning I found the text of the Senate bill HR1 - Tax Cuts and Jobs Act that was passed last night and skimmed through it looking for anything about the Federal electric.

The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. Meanwhile Republicans on the senate managed to draft a bill that kept both in place. 15 2 For taxable years beginning on or after January 1 2022 but before January 1 16 2026 an eligible taxpayer shall be.

Build Back Better Act. Utah state Rep. Its good news for General Motors which recently begged the government.

The latest proposal involves up to a 12500 EV tax credit an increase from the current 7500 EV credit but with a number of potential changes. Senator Joe Manchin said on Sunday hes a no on the sweeping spending plan which includes up to. EV tax credits.

Congress is poised to fix the most annoying thing about buying an electric car The new EV tax credit would be 12500 and refundable. There has even reportedly been talk of changing the EV tax incentive into a refundable credit. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

7500 EV tax credit reinstated 2500 for made 2500 for union made. EV tax credit bill from Senate Finance Committee. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

This bill would allow a credit against those taxes for each taxable year beginning on or after January 1 2017 and before January 1 2020 in an amount equal to 10 of the costs paid or incurred by the taxpayer for the purchase of electric vehicle infrastructure as defined during the taxable year for use at a qualified dwelling as defined not to exceed 2500 as specified. Text for HR5376 - 117th Congress 2021-2022. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

NADA Update on EV Tax Credit NADA. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the.

Manchin a no on Build Back Better bill putting 12500 incentive in doubt. The credit amount will vary based on the capacity of the battery used to power the vehicle. This bill would allow a credit against those taxes for each taxable year beginning on or after January 1 2025 and before January 1 2030 in an amount equal to 40 of the amount paid or incurred in qualified costs by a qualified taxpayer during the taxable year for the installation of specified electric vehicle supply equipment in a covered multifamily dwelling.

B Limitation. On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. Add an additional 4500 for EVs assembled in.

The way this works is that in the initial draft of the 15 trillion House tax bill the 7500 electric-vehicle tax credit and the wind production tax credit would both be eliminated. Bill Text 2022-03-03 Provides corporation business tax credit and gross income tax credits for purchase and installation of certain electric vehicle charging stations. Changes include raising the federal EV tax rebate ceiling to 12500 and opening the door for automakers who already exhausted their production quotas.

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. Suzanne Harrison D-Draper has offered a bill HB 0221 that would authorize a tax credit for the purchase of an electric vehicle EV a plug-in hybrid or a hydrogen vehicle with a sale price of under 55000. The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if.

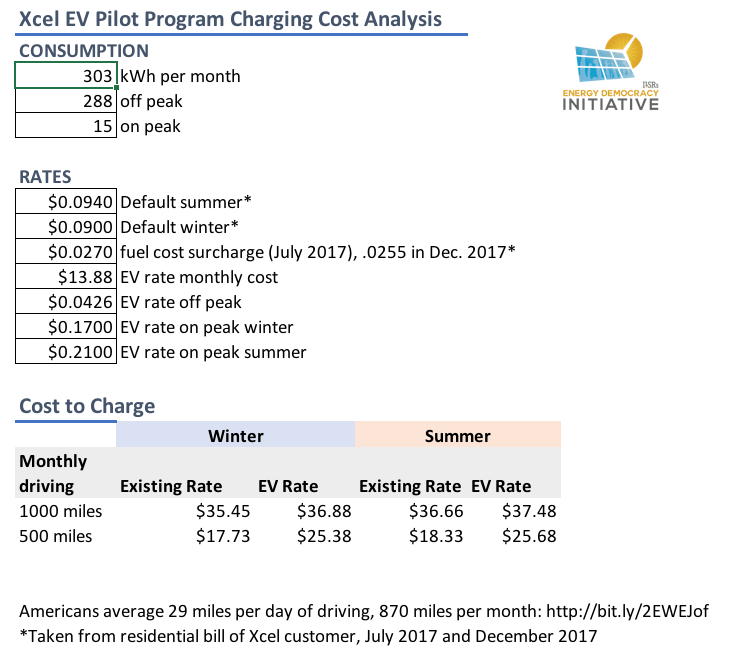

Electric Car Electric Bill Off 71

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Electric Car Electric Bill Off 71

Chelsea Sexton Evchels Twitter

Electric Car Electric Bill Off 71

Oil Industry Cons About The Ev Tax Credit Nrdc

Latest On Tesla Ev Tax Credit March 2022

Electric Car Electric Bill Off 71

Latest On Tesla Ev Tax Credit March 2022

The State Of Electric Vehicle Tax Credits Clean Charge Network

Electric Car Electric Bill Off 71

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

A Fleet Manager S Guide Electric Vehicle Tax Credits

How Much Does An Ev Increase Electric Bill Off 69

Oil Industry Cons About The Ev Tax Credit Nrdc